Extra Mural Studies – Are you covered?

Three things you need to know about insurance for your EMS

1. What cover does your placement practice have?

Before your EMS, it’s important to ask your placement practice if they have the following insurance in place to protect you:

Public Liability

When you’re acting on behalf of the practice, this covers the cost of a claim made by a member of the public for injury or damage to their property.

Employers’ Liability

If you are injured at work, most insurance policies held by employers would treat people on a work experience scheme as an employee.

Professional Indemnity

This covers the cost of a claim relating to professional services, e.g. if an animal is injured. As you will be assisting qualified vets under their supervision, most indemnity cover held by vets will provide you with the protection required.

Don’t think it won’t happen to you…

…A BVA student member was kicked in the face by a horse whilst on a farm EMS placement. Since the incident took place in the UK, she went to an NHS hospital for several days. Her EMS Insurance covered £50 per night for the hospitalisation. In addition, she was left with a facial scar and the EMS Insurance paid a £10,000 lump sum. Fortunately, she was able to resume studies and is a now a qualified vet. However, if the situation had been worse and she wasn’t able to work as a vet, the policy would have paid £50,000 lump sum.

2. Why do I need EMS Insurance?

During your EMS placement, it provides you with the following cover:

Personal Accident Cover

This provides you with ‘lump sum’ compensation if you sustain certain major injuries or disablements as a result of an accident.

Personal Liability

This will help to defend you if you’re accused of being personally responsible for injuring another person or causing damage to property. This is the kind of cover many people would have as an additional part of their home insurance. However, as many students wouldn’t have home insurance, this cover helps to close that gap.

3. If your EMS is abroad, is there more to consider?

Travel Insurance

To be clear, your EMS Insurance won’t cover medical expenses. That’s where travel insurance comes in. Many policies won’t cover injury or illness whilst working abroad, so it’s important that you arrange a travel policy to cover this.

Liability Cover

As with EMS in the UK, you should make sure that your work placement still provides Public Liability, Employers’ Liability and Professional Indemnity. In the past, we have seen situations where placements abroad haven’t given such protection under their insurance.

We recently took over the BVA’s Instagram account to answer members’ questions. Just in case you missed it…

Watch the full video here:

If you have any questions or concerns

Call our specialist team on 01823 250739.

Read more information here, with scenarios of how our EMS cover can help BVA members like you.

Join the BVA

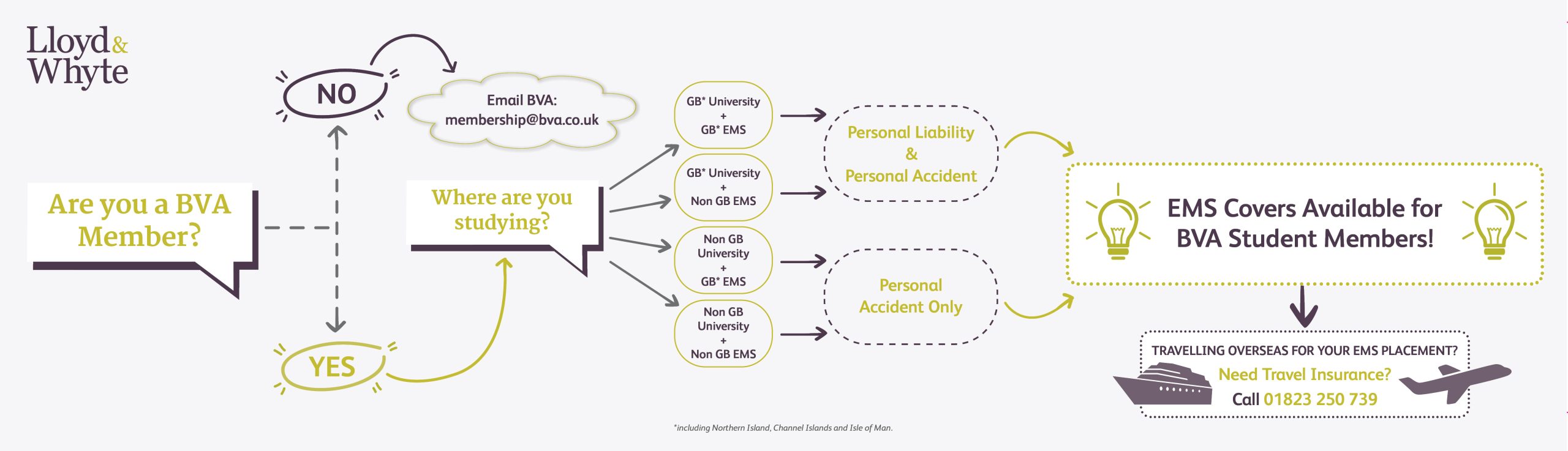

EMS Insurance is automatically included as part of your BVA student membership

Travel Insurance

Travel Insurance is a necessary supplement to EMS Insurance. Along with the normal cover provided under Travel Insurance policies, we offer a product which will provide you with cover for medical expenses whilst working abroad. It can also be extended to cover other activities you intend to take part in whilst abroad such as Skiing, Bungee Jumping or Scuba Diving.

Find us on Social Media

You can also keep up to date by following us on social media.